The concept of 'Clown World' paints a vivid picture of a society spiralling into dystopia—a society that has traded logical reasoning for disorder and mindful introspection for superficiality. One doesn't need to look far in today's age to witness the chaos taking hold. Rationality seems to be fading, and alarmingly, younger generations increasingly fall prey to the allure of ideological movements, which many perceive as an antidote to pervasive nihilism.

In this essay, I will explore the profound link between the unsettling trajectory of our society and state interference with our monetary systems. The state's meddling in financial affairs gives rise to a plethora of societal issues, ranging from moral deterioration and an overemphasis on gender debates to the unsettling reliance on the state for fundamental needs. We witness declining critical thought, eroding family units, rising mental health challenges, and the ascendancy of an ill-equipped ruling class.

The manifestations of the "Clown World" phenomenon are evident in our daily lives. Contemporary instances include governmental overreach into medical decisions, endorsement of "woke" ideologies and intricate gender discourses, and justifications for imposing taxes and limiting free markets under the guise of environmental concerns. But how does all this intertwine with the degradation of our currency?

The degradation of money inherently signifies a shift towards high-time preference behaviour. Given that money forms the bedrock of all human exchanges, society finds itself nudged towards short-term, often impulsive, decisions and actions.

A driving factor behind governmental money printing is its aim to artificially prop up market activities that wouldn’t naturally be viable. This not only skews economic landscapes but also misdirects resources that might have found more efficient applications in an unobstructed market. Additionally, when large corporations falter due to their own missteps and are then bailed out with money that was produced at virtually no cost, it muddles our understanding of what products and services genuinely hold value in the market's eyes.

Some prime examples are the bailouts of major banks, the artificially bloated housing markets, or entire sectors like pharmaceuticals or the military-industrial complex, which increasingly resemble extensions of the state.

A noteworthy observation is the surge of "wokeness" championed by major corporations. This isn't merely a spontaneous alignment with progressive values but is often influenced by assessment criteria from global investment giants like Blackrock and Vanguard. The ESG rating system—standing for environmental, social, and governance—evaluates companies not predominantly on fiscal performance but on their alignment with ideologically driven movements.

This encompasses support for LGBTQ rights, adherence to diversity and inclusion metrics, and a company's environmental footprint. It's also worth noting that this ESG rating played a significant role in steering the narrative during the COVID-19 pandemic, impacting public perceptions and reactions.

Companies like BlackRock and Vanguard are more likely to invest in firms that comply with ESG guidelines, despite some decisions appearing economically unsustainable. BlackRock, which manages around $9 trillion in assets, has deep ties to the U.S. government, evidenced by several of its employees and board members who have previously held significant government roles. For instance, Brian Deese, once an advisor to President Obama, now leads the National Economic Council under President Biden, and Wally Adeyemo, former senior international economics advisor to Obama, is now the deputy Treasury Secretary. Richard Pyle, Thomas Donilon, and Dalia Blass are additional examples of this tight-knit relationship between BlackRock and the government. In March 2020, the New York Fed even entrusted BlackRock's advisory arm with its bond purchases. This close relationship suggests that BlackRock's ESG focus might align with broader governmental policy directions.

it is quite apparent that Blackrock sits so close to the money printer that their agenda of wokeisim is simply a part of a propaganda campaign perpetuated by the US government.

The Psychology of Fiat

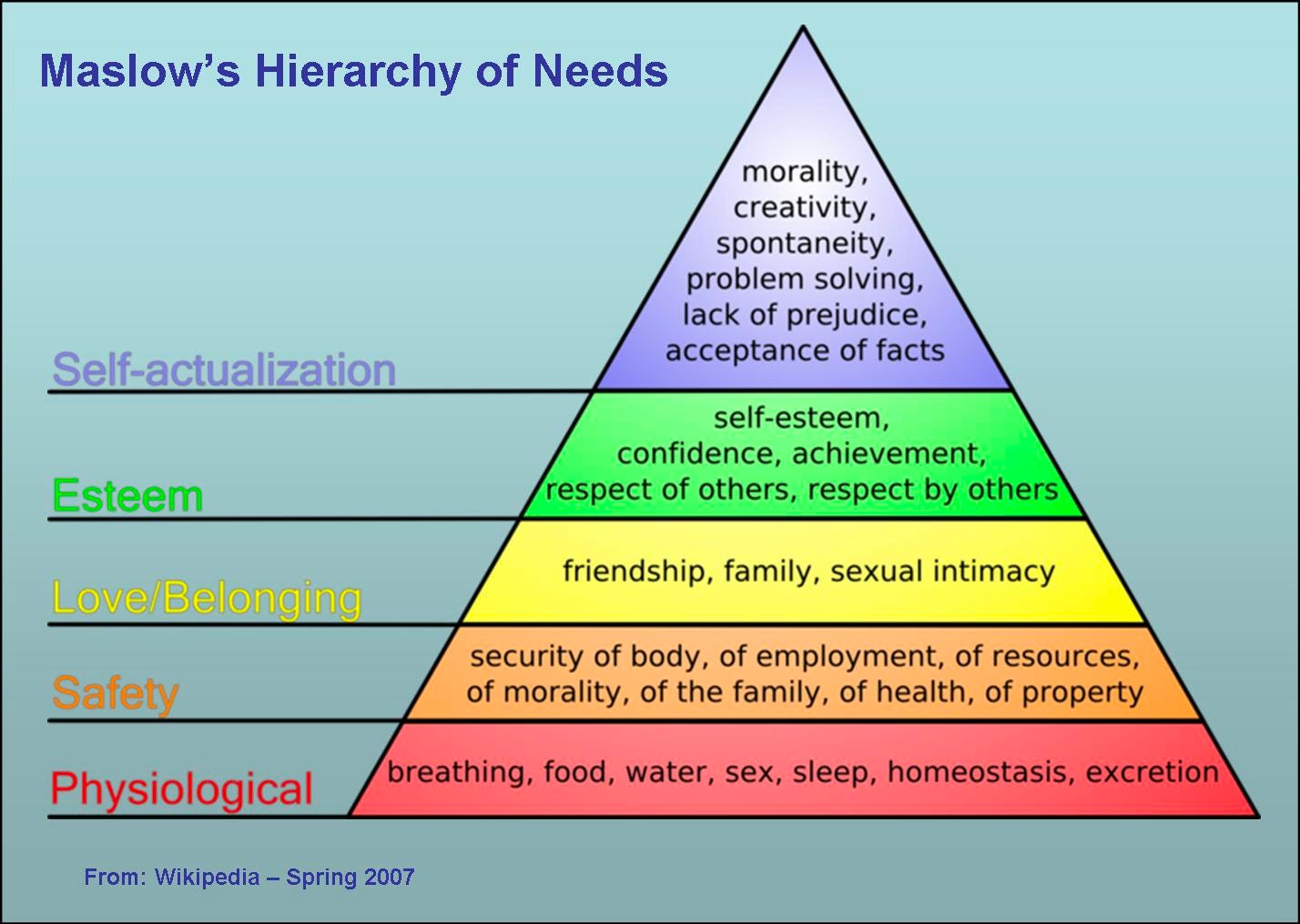

United societies tend to achieve more by raising the standard of living through trade, leading to higher degrees of complexity. As this happens, the common goals of the individual move up on Maslow's hierarchy of needs

As a society or culture moves up on the hierarchy, unification becomes more difficult as basic needs are met due to the division of labour and diversification of skills. In societies where the state provides and or interferes with the lower needs, individuals can not fulfill their higher needs successfully and therefore lack higher senses of purpose. Goals also diversify at this point, and a common form of money is required to communicate value. If the money is easily verifiable, hard to produce, and efficient as a unit of account, society will then be unified through a common incentive to trade and cooperate. The harder the money, the more the incentive to cooperate and the greater focus on providing for the future, as there is an incentive to save. This is why we see higher levels of engineering prowess in civilizations with harder money (the Colosseum and the Empire State Building)

More so because money printing is controlled by humans who, by nature, are very easily corrupted, the flow of monetary energy can be easily directed into organizations that propagate these ideologies, further dividing society.

In most developed nations, the political landscape is typically dominated by two or three major parties. To ascend to power, each party must put forth a candidate who can resonate with the masses and secure their favour. This often hinges on an understanding of human psychology, particularly the insight that people tend to be driven more by emotion than by logic.

Consequently, candidates often align themselves with ideological movements that emotionally resonate with their target demographics, making promises that alleviate the voters' perceived burdens. Essentially, politicians become salesmen, presenting themselves as the solution to the populace's challenges. This is reflected in the way products and ideologies are advertised; campaigns rarely appeal to pure logic, instead favouring emotionally charged content. Once elected, however, some politicians may prioritize corporate interests, backed by lobbying or financial support, over the very constituents they promised to serve.

The act of printing fiat currency increases society's reliance on political leaders, granting them power to steer the flow of capital as they deem necessary. This can diminish the importance of personal responsibility, paving the way for a societal vacuum. Within this vacuum, extremism and ideologies centred on victimhood can flourish. Conversely, when individuals embrace personal responsibility, exercise discipline, and use abstract reasoning to plan their futures, they discover a deeper sense of meaning and purpose. By aiming for sovereignty in their lives, they derive a greater sense of fulfillment.

High-time preference behaviour refers to the tendency to prioritize immediate rewards or outcomes over long-term benefits. It essentially means favouring short-term gratification over longer-term planning and benefits. This behaviour, when exhibited consistently, can have implications for the brain, especially the prefrontal cortex (PFC), which is responsible for executive functions such as planning, decision-making, and impulse control.

Neuroplasticity: The brain is a dynamic organ, and its structure and function can change based on experience and behaviour. The principle of "use it or lose it" applies here. Engaging in repeated behaviours can strengthen neural pathways associated with those behaviours. Conversely, neglecting certain skills or behaviours can weaken or reduce the associated neural pathways. Regularly favouring immediate gratification (high time preference) might strengthen neural circuits associated with impulsivity while weakening those associated with patience, long-term planning, and delayed gratification.

Dopamine and Reward: High-time preference behaviours often involve seeking immediate rewards. This can lead to frequent and rapid releases of dopamine, a neurotransmitter associated with pleasure and reward. Over time, consistently high levels of dopamine release can desensitize the brain's reward system, making it more difficult to derive pleasure from less stimulating or more delayed rewards. This can further reinforce impulsive behaviours as individuals seek out immediate sources of pleasure or stimulation.

Stress and the Prefrontal Cortex: High-time preference behaviours can sometimes result from or lead to increased stress, especially when considering the long-term consequences of repeated short-term decisions. Chronic stress has been shown to negatively impact the PFC, reducing its ability to function effectively. High levels of stress hormones, such as cortisol, can inhibit the PFC and impair its function, promoting even more impulsive decisions.

Impaired Cognitive Functions: Over time, consistently prioritizing immediate rewards might reduce the PFC's capacity for abstract reasoning, problem-solving, and considering future consequences. This can make it increasingly difficult for individuals to make decisions that involve delaying gratification or considering long-term outcomes.

In an economy where money's value becomes as unstable as a game of hot potato, citizens tend to develop a high-time preference, making decisions largely based on immediate necessities. This dynamic pushes a significant portion of the population to rely on government social programs. With such dependence, it becomes easier for those in power to guide these individuals towards any particular ideology. I believe that the present emphasis on matters of gender, sexuality, race, and identity politics is a deliberate strategy to accentuate our differences, fostering division among us.

The debasement of currency not only affects the mindset of the general populace but also deeply impacts the psyche of the ruling elite. The unchecked power to effectively print solutions to challenges and finance their instruments of control can lead to an inflated sense of omnipotence among these leaders, causing an insatiable addiction to wielding influence over vast populations.

Historically, the rise to empire status has been closely tied to the creation and dominance of a robust currency. This currency is then inflated to fund various avenues of power projection, be it through military conquest or economic manipulation. Yet, it's this very cycle—using inflated currency as a tool to further extend influence—that has led to the decline of numerous empires. Our current empire seems to be treading a similar path, with signs pointing towards an inevitable downfall.

Bitcoin Fixes This!

In a world where the distortions of fiat money have clouded our perceptions and fueled a circus of absurdities, it's Bitcoin that offers clarity. Money—our medium to store and exchange value—must reflect the true energy and effort of its users. But when money becomes a mere tool for centralized entities to further increase their ability to control. society spirals into inefficiency, irrationality and, ultimately tyranny.

Why Traditional Money Falters

The current global chaos isn't just a happenstance; it's the result of a flawed financial foundation. When there's a gaping discrepancy between the symbol (money) and the actual value or energy it represents, the entire system staggers. And that's what we've seen with most traditional currencies: they've become detached from tangible worth, manipulated by those in control, leading to a world where planning for the future feels like an exercise in futility.

Bitcoin: A Restoration of Reality

Here's where Bitcoin differs and shines: it's built upon genuine labour and energy. Its proof-of-work mechanism ensures that every Bitcoin in circulation has physical energy embedded within. This isn't just theoretical; miners invest substantial resources and electricity to bring new Bitcoins to life. Thus, when you engage in trade with Bitcoin, you're not just exchanging digital numbers; you're trading tangible, energy-backed value.

Additionally, Bitcoin's decentralized nature challenges the established hierarchies and reorients power dynamics. Instead of being in the clutches of centralized entities, Bitcoin offers financial self-sovereignty. It champions long-term planning, patience, and prudent foresight—values that seem lost in today's fiat world.

The Dawn of Rational Governance

In a Bitcoin-centric world, the governance structure undergoes a transformation. Governments would no longer play the role of omnipotent overlords, but service providers, earnestly competing for the trust and patronage of an enlightened populace. These decentralized entities, much like city-states, would emerge, catering to diverse societal needs, driven by genuine value propositions rather than control under the disguise of safety.

Conclusion

Today's societal challenges are fundamentally rooted in a compromised monetary system. As global dynamics become increasingly volatile and illogical, Bitcoin emerges as a rational alternative. Beyond merely rectifying financial instability, Bitcoin signals a potential shift towards an environment where rigorous logic supersedes transient trends. By adopting Bitcoin, we're not merely transitioning to an alternative currency; we're facilitating a period where tenets such as sovereignty, and intrinsic value regain prominence.

In wrapping up, our current epoch stands at a crossroads. We have the technological and energetic prowess that surpasses previous civilizations. However, there's a clear inefficiency in how we store and communicate this energy—our money. Bitcoin offers a solution, promising not only a more efficient storage of value but for the first time in history a monetary system that is not in control of the state. Its adoption could signify a leap, not just in how we transact but in how we exist, coexist, and govern. As we envision the architectural wonders of our future, we are reminded of the words of Aleks Svetski: "We cannot build castles in the sky atop a lie." Bitcoin stands as a testament to this truth, offering a solid foundation for our aspirations. As we stand on the precipice of a new era, Bitcoin shines as a beacon, illuminating the path to a brighter shall I say oranger future, the age of the sovereign individual.

Acknowledgments

I'd like to extend my gratitude to Tomer Strolight and Luke Mikic for their invaluable feedback and insights. Their guidance was instrumental in shaping this article. Also, I thank Aleks Svetski and Saifdean Ammous for their foundational work that inspired and informed this piece. Their influence has been pivotal.

A special thanks to @Bitcoin4Trudeau and @PlateLicker_21m for their meticulous help in proofreading. Your attention to detail was immensely appreciated.

Lastly, to you, the reader – thank you for your time and engagement and for continuing to support my work.

Sources and Citations

Bismarck Analysis (Date Unknown). "BlackRock's Close Relationship with [specific topic or context from the article]." Retrieved from

.

Bloomberg (August 11, 2022). "Biden Ties to BlackRock Deepen with Latest Treasury Hire." Retrieved from https://www.bloomberg.com/news/articles/2022-08-11/biden-ties-to-blackrock-deepen-with-latest-treasury-hire?embedded-checkout=true.

Business Insider (December 2020). "What to Know About BlackRock, Larry Fink, and the Biden Cabinet." Retrieved from https://www.businessinsider.com/what-to-know-about-blackrock-larry-fink-biden-cabinet-facts-2020-12.

BNN Bloomberg (Date Unknown). "Biden Ties to BlackRock Deepen with Latest Treasury Hire." Retrieved from https://www.bnnbloomberg.ca/biden-ties-to-blackrock-deepen-with-latest-treasury-hire-1.1804709.

The New York Times (June 24, 2021). "[Specific article title related to BlackRock and the Fed]." Retrieved from https://www.nytimes.com/2021/06/24/business/economy/fed-blackrock-pandemic-crisis.html.

Neural Plasticity and Behavior - The ability of neural pathways to adapt based on experiences, termed as neural plasticity, stands as a cornerstone in neuroscience.

Huttenlocher, P. R. (2002). Neural plasticity: The effects of environment on the development of the cerebral cortex. Harvard University Press.

Use it or Lose it Principle - Emphasizing the strengthening of skills through continuous usage and the potential degradation through neglect.

Draganski, B., & May, A. (2008). Training‐induced structural changes in the adult human brain. Behavioural brain research, 192(1), 137-142.

Dopamine and Reward - Highlighting dopamine's role in the brain's reward and pleasure circuits, and the potential alterations from excessive or artificial stimulation.

Volkow, N. D., Wang, G. J., Fowler, J. S., & Tomasi, D. (2012). Addiction circuitry in the human brain. Annual Review of Pharmacology and Toxicology, 52, 321-336.

Stress and the Prefrontal Cortex - Discussing the impacts of chronic stress on the brain, particularly the prefrontal cortex, influencing decision-making and impulsivity.

Arnsten, A. F. T. (2009). Stress signalling pathways that impair prefrontal cortex structure and function. Nature Reviews Neuroscience, 10(6), 410-422.

Impaired Cognitive Functions - Describing the prefrontal cortex's role in high-order cognitive functions and the implications of its impairment on reasoning and problem-solving.

Miller, E. K., & Cohen, J. D. (2001). An integrative theory of prefrontal cortex function. Annual review of neuroscience, 24(1), 167-202.